Our history

Höegh's shipowning history goes back to 1927 and since then the Company has been a pioneer in the international shipping industry.

-

1927

Mr. Leif Høegh founded Leif Höegh & Co. as a tanker owner, and since then the Company has been a pioneer in the international shipping industry. The owning and operation of oil tankers came to form the mainstay of Leif Höegh & Co from the early days. However, from a process of transition in the 1960s, the Company diversified into new activities, introducing new concepts for transportation.

-

1970-2000

Having operated combined oil/bulk/ore carriers (OBO), the Company now started transporting cars with lift on/lift off vessels. In 1970, a joint venture was formed with Ugland which shaped Höegh-Ugland Auto Liners (HUAL). This company became the basis for developing Höegh into a world leading RoRo operator.

In 1995, Höegh Fleet Services AS was established as a separate ship management entity, serving Leif Höegh & Co's fleet. In March 2000, Leif Höegh & Co acquired the other 50% of HUAL and five years later it was renamed to Höegh Autoliners.

-

2006

In 2006, the Company was restructured into two separate entities - Höegh Autoliners and Höegh LNG - with a common holding company (Leif Höegh & Co Limited). The ship management expertise is maintained in Höegh Fleet Services.

-

2008

In 2008, Höegh Autoliners relocated its shipowning activities from Bermuda to Norway. The same year the Company acquired a fleet of 12 car carriers from A.P. Moller - Maersk (APMM) and APMM became a minority shareholder holding 37.5 per cent of the shares in Höegh Autoliners. A year later APMM uses the option to purchase another 1.25 per cent of Höegh Autoliners.

-

2015-2016

In 2015-2016, Höegh Autoliners took delivery of the largest and greenest vessels in the market: the Horizon class with a capacity of 8 500 car equivalent units (CEU).

-

2021

In 2021, a conversion to a public limited liability company and change of entity name from Höegh Autoliners Holdings AS to Höegh Autoliners ASA took place. In the same year, Höegh Autoliners completed its first carbon neutral voyage from Europe to South Africa. Later in 2021, the Company successfully completed a private placement and admission to trade on Euronext Growth.

-

2022

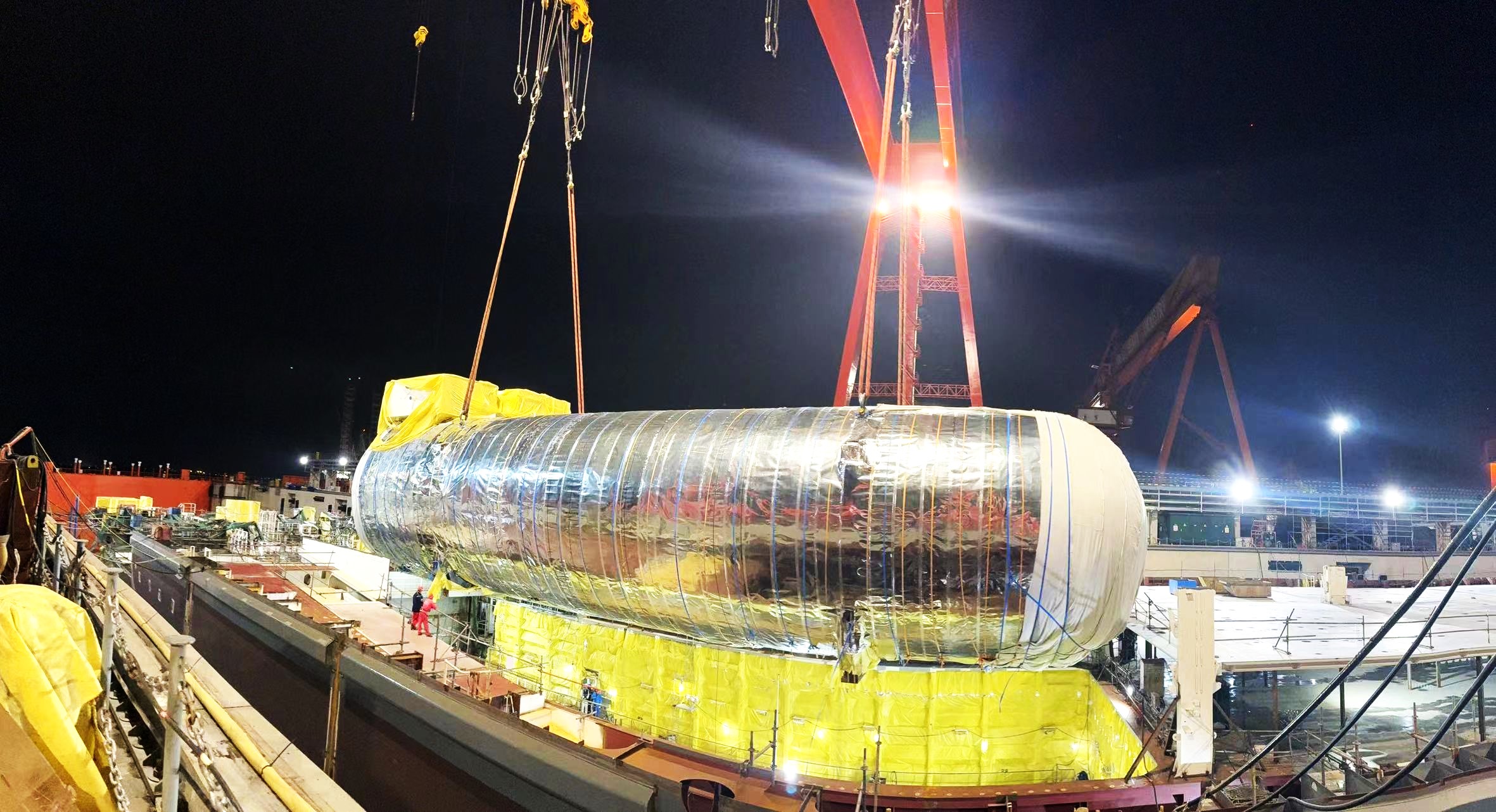

A contract with China Merchants Heavy Industry to build a series of its zero-carbon ready Aurora Class vessels was signed in January 2022. The Company uplisted to the main market on the Oslo Stock Exchange in May, only six months after the admission to trade on Euronext Growth. The Company commenced distribution of quarterly dividends to shareholders from August. Purchase options for three leased vessels were exercised and the Company joined the First Movers Coalition (FMC), committing to accelerate the demand for zero-carbon technology.

-

2023

Höegh Autoliners declared an option to build four additional Aurora Class vessels (9-12). The Company has an option to build another four vessels (vessels 13-16), as well as slot reservations for additional four vessels (vessels 17-20). As part of optimising its fleet, the Company sold Höegh Bangkok, and purchased Höegh Berlin. In addition, a purchase option for Höegh Jacksonville was declared. The Company also signed long-term contracts with several major customers. The Company was included in the OBX index on the Oslo Stock exchange, a milestone for the Company, less than three years after the listing.

Related topics

Key highlights 2023

2023 was the best financial year in the Company's history. The strong deep sea transportation demand together with the imbalanced supply demand, characterised by limited capacity growth and operational disruptions, pushed the spot rate to a new high level.