Climate-related financial disclosures and governance

Introduction

The year 2023 showed that extreme weather conditions could impact global logistics, where the drought in the Panama Canal served as a key example, forcing several shipping companies to alter their sailing patterns. Predicting how climate change might affect our organisation in the future is not an easy task, but this serves as a firm example of how physical climate risks can have a real impact on our operations. As we continue our decarbonisation journey, contributing to the green energy transition, physical climate risks, along with transitional risks and opportunities, will play an important role in the coming years.

Embedding climate risks and opportunities into our daily operations has become an important part of ensuring a resilient corporate strategy that informs our operational decision making and investments. As customer and other stakeholder demands shift towards environmentally friendly solutions, we are increasing our focus on both our risk assessment and opportunity identification to remain the preferred PCTC operator, making decarbonisation of our customers’ supply chains possible.

Transition risks

We leverage the Task Force on Climate-related Financial Disclosures (TCFD) guidelines to assess, manage, and mitigate risks while identifying climate-related opportunities. Transition risks and opportunities are deemed to be the most important aspects to consider when assessing what might be the significant drivers for our business. The biggest risk is related to whether we are able to decarbonise our operations at a pace that corresponds to customers’, investors’, regulators’ and other external stakeholders’ expectations. This is closely linked to the technology risks arising from the fuel technology chosen for our fleet transition program, and to the market risk related to the commercial availability and economic viability of green fuels and the customers willingness to take part in the green transition.

Physical risks and scenario discussion

As found by the Intergovernmental Panel on Climate Change Sixth Assessment Report(IPCC AR6), financial risks related climate change increase with every increment of global warming, indicating higher physical climate risks in an intermediate to high GHG emission scenario (RCP4.5 w/warming of 3C to RCP 8.5 w/warming exceeding 4C) compared to a very low/low GHG scenario (SSP1-2.6 w/warming of 1.5 to 2C). All else equal, transition risks are considered lower in such scenarios. Höegh Autoliners acknowledges the potential physical risks that might impact our operations going forward. Among other things, an increased frequency of flooding and droughts may lead to operational downtime and increased operational costs, tougher and more extreme weather conditions could negatively impact health and safety of our seafarers, suppliers and/or local infrastructure (access to ports/docs), and more extreme conditions may cause political instability, disruptions and migrations that can impact our operational profile. We are continuously assessing our decarbonisation strategy to ensure that it is resilient towards physical climate risks.

For lower temperature scenarios, extreme weather events are still expected to occur, but with reduced frequency and intensity. Transitional risks would be more dominant, through more regulatory pressure including performance requirements and carbon taxes, and increased demands from our customers to deliver greener solutions faster. Höegh Autoliners is in favour of a lower temperature scenario and have already taken several decisive steps to both contribute and adapt to this.

Business opportunities

We believe that most of our risks are tied to a corresponding opportunity ready to be capitalised upon if we take the right actions. We are currently experiencing an increased interest in our ongoing fleet transition, including our newbuilding program of 12 ammonia-ready Aurora Class vessels with the first two vessels to be delivered in Q3 2024. Our most important opportunities identified are:

- Increasing the fleet’s energy efficiency through an ambitious decarbonisation strategy will not only reduce our operational expenses due to less fuel consumption or reduced costs, but it also positions us as a first mover in our segment preparing us to assist in the decarbonisation of our customers’ supply chains. This will open opportunities to partner with customers who share the same business philosophy as us.

- Environmental aspects are becoming a larger part of tender processes, and improved fuel efficiency that meets our own and regulatory targets and requirements is likely to give us a competitive advantage in these processes.

- The transition to a carbon neutral maritime industry will affect all shipping companies. Being a smaller and more agile player may be an advantage in this transition.

- Over the past years, we have seen an increase in electrical vehicles being shipped. The change from fossil fuelled vehicles to electrical cars will likely generate opportunities for Höegh Autoliners as our Aurora Class vessels are designed to carry heavier electrical vehicles on all cargo decks.

- By actively taking part in different initiatives on our path to zero, from partnering with green ammonia suppliers for future supply, distribution, and delivery of green ammonia, to agreements with partners to contribute directly to the digitisation and decarbonisation of our operations, we have substantiated our commitment to sustainability during the year. The current interest from partners and external stakeholders in our decarbonisation strategy serves as a promising indicator for us to both explore and establish new strategic partnerships in the coming years.

- A strong decarbonisation strategy and compliance with current and future regulations may lead to more available and reduced cost of capital.

We continue to explore innovative ways to optimise our fleet’s efficiency, and through a properly executed decarbonisation strategy, we strongly believe that we will solidify our leading role in reducing our own, as well as our customers’ carbon footprint.

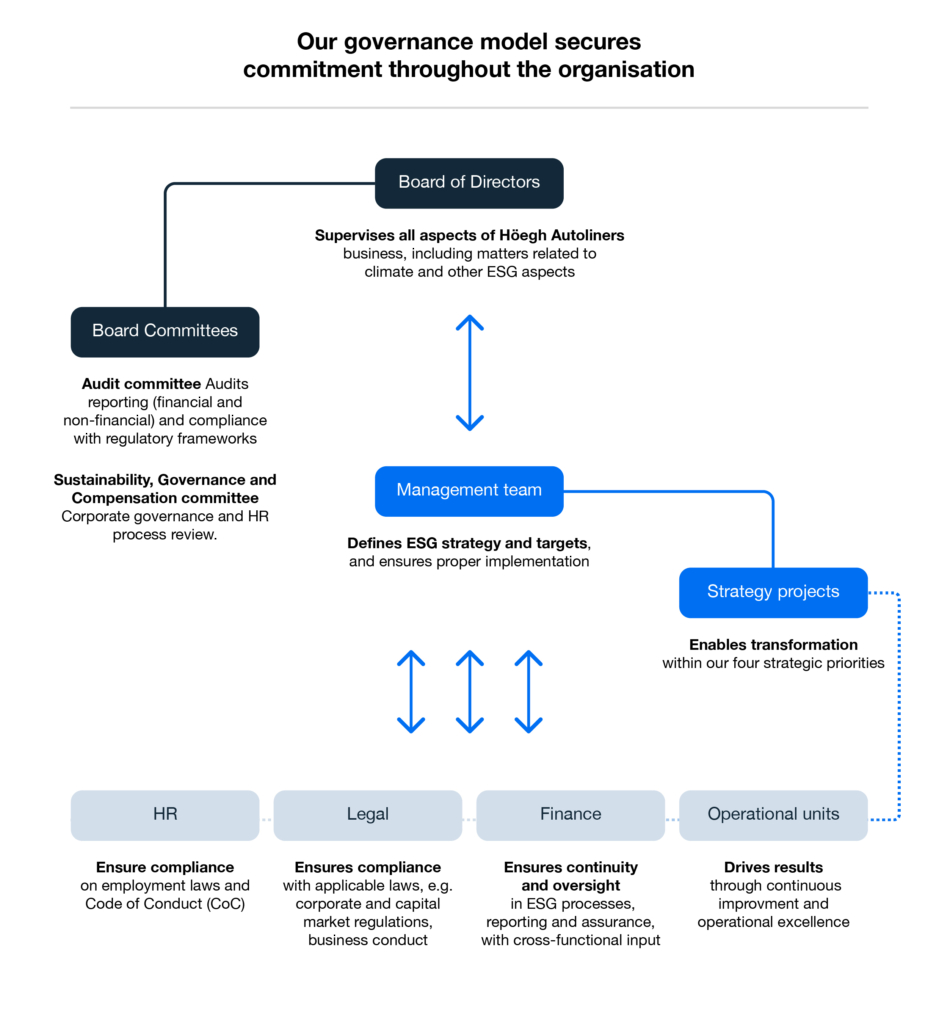

Risk management

The first step in identifying and assessing risks involves data and intelligence gathering. Höegh Autoliners pays close attention to the work of the IMO, relevant research, global macro trends and the development of local and global regulations. We conduct stakeholder engagements continuously, including customers, financial institutions, investors, and other stakeholders to stay updated on risks that arise. The second step is to evaluate the potential impact of each regulation or event, along with the likelihood of its occurrence. The risk is a product of impact and likelihood and is evaluated against three financial thresholds, low, medium, and high financial impact. To identify, manage and mitigate climate related risk, Höegh Autoliners uses inputs from the expected development of regulations, fuels prices, carbon prices, technologies, and the market, into its budgeting and forecasting processes. Our cross functional sustainability team is responsible for identifying and assessing climate related risks and mitigating actions. They inform the management team about risks and suggested mitigating actions. The management team informs the Board. An overview of our Corporate Sustainability Governance is presented below.

Metrics and Targets used to manage climate-related risks and opportunities

Höegh Autoliners has set clear targets for its decarbonisation efforts to assess and manage climate related risks and opportunities. We aim to reduce our carbon intensity (CgDIST, a carbon intensity measure in accordance with the Poseidon Principles) by more than 30% by 2030, from a 2019 level. In addition, we target to reach net-zero emissions in our operations by 2040, a commitment we are working on every day to materialise. We are tracking performance against our targets annually and report our progress in our quarterly reports in addition to the annual reporting. Updates on our performance against the targets are also reported to the Board of Directors quarterly.

Governance model and commitments

Governing our strategy

As our governance model illustrates, our board of directors is the governing body that approves the overall strategy of the Company, and approves the investments needed to reach our targets and goals. Through approving and issuing new and revised policies, the board incorporates all aspects of Höegh Autoliners’ business, including matters related to climate change and other sustainability topics.

Our Audit committee provides oversight of our reporting and the audit process, including our system of internal controls and compliance with laws and regulations. Other than following up on the financial reporting and audit process, the 2023 focus for the Audit committee was on overseeing the Group's compliance work, risk management and IT security.

The Sustainability, Governance and Compensation Committee (SGCC) ensures thorough and independent preparation of matters relating to governance and compensation of the Company’s executive management, and to ensure focus on sustainability. In 2023 the SGCC reviewed compensation elements for both staff and the Executive team along with longer term organisational development plans given the shift in gear towards achieving our sustainability goals.

The responsibility for defining and implementing our strategy and targets is governed with our management. The work with our sustainability topics is placed within its corresponding departments, defined, and prioritised within the boundaries of our four strategic priorities and is substantiated though our cross departmental strategic projects. Our strategic projects are owned and sponsored by a member of the management team, who is driving the project and responsible for the final content presented to the management team and to the board.

The way forward

To ensure efficient and high-quality sustainability reporting, we are continuously working to develop and improve our internal reporting processes. Key focus for 2024 will be to further develop and implement internal controls over sustainability reporting, and to make sure our reporting framework is robust and ready to meet the upcoming reporting regulations. We will also look into how we can strengthen our scenario analysis even further.

EU Taxonomy

The taxonomy is a classification system that defines criteria for economic activities that are aligned with a net zero trajectory by 2050 and the broader environmental goals other than climate. It allows companies to share a common definition of economic activities that can be considered environmentally sustainable.